Improve Enterprise Efficiency Through 3 Effective Strategies Using These 10 Financial KPI's

- Lorenzo Ostili

- Jul 5, 2024

- 5 min read

Updated: Jul 19, 2024

Understanding Key Financial KPIs and Strategies to Enhance Enterprise Efficiency |

Key Financial KPIs |

Strategies to Utilize Financial KPIs |

Conclusion |

Understanding Key Financial KPIs and Strategies to Enhance Enterprise Efficiency

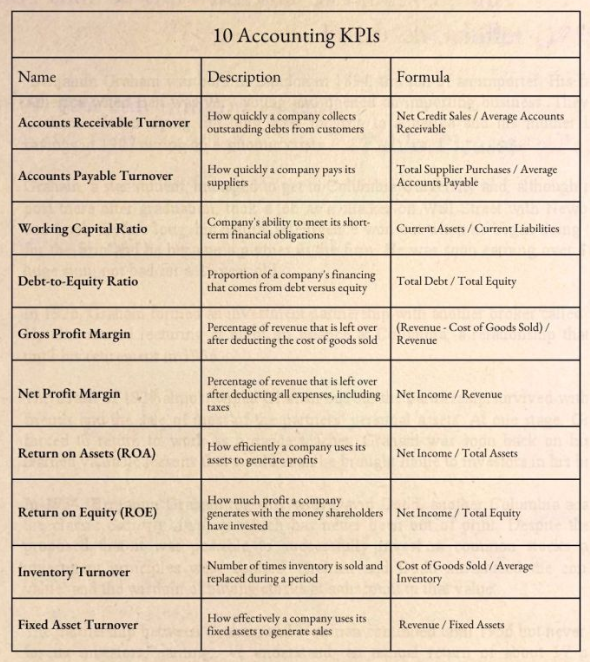

Tracking financial Key Performance Indicators (KPIs) is crucial for assessing the health and efficiency of an enterprise. Here are ten essential financial KPIs and three strategies for using them to improve business efficiency.

Key Financial KPIs

Strategies to Utilize Financial KPIs

Strategy 1: Enhancing Cash Flow Management

1. Optimize Accounts Receivable Turnover

Implementing stricter credit policies and efficient collection processes can significantly improve the accounts receivable turnover ratio. Here’s how to do it:

Credit Policies: Tighten credit terms to reduce the number of days customers have to pay. Conduct thorough credit checks before extending credit to new customers.

Incentives for Early Payments: Offer discounts for early payments to encourage quicker settlements.

Efficient Invoicing: Automate invoicing to ensure timely and accurate billing. Implement electronic invoicing to speed up the process.

Collection Processes: Establish a systematic follow-up process for overdue accounts. Use automated reminders and, if necessary, collection agencies to recover overdue payments.

Customer Relationships: Maintain good relationships with customers to facilitate timely payments and address any disputes promptly to avoid delays.

2. Manage Accounts Payable Turnover

Effective management of accounts payable turnover involves negotiating better payment terms while maintaining supplier relationships:

Payment Terms: Negotiate extended payment terms without incurring penalties or damaging relationships. This helps keep cash flow positive.

Early Payment Discounts: Take advantage of discounts offered for early payments if it makes financial sense, balancing the cost savings against cash flow needs.

Payment Scheduling: Align payment schedules with cash inflows to ensure that the company is not cash-strapped at any point.

Supplier Relationships: Build strong relationships with suppliers to gain favorable terms and flexibility during tight cash flow periods.

3. Maintain a Healthy Working Capital Ratio

The working capital ratio is a measure of a company's short-term financial health. Maintaining a healthy ratio involves:

Asset Management: Ensure that current assets such as inventory and accounts receivable are managed efficiently. Avoid overstocking and regularly review receivables to reduce days sales outstanding (DSO).

Liability Management: Monitor current liabilities to ensure they do not exceed current assets. Avoid taking on short-term debt that could strain liquidity.

Regular Monitoring: Continuously track the working capital ratio to promptly address any discrepancies. Use financial software for real-time monitoring and analysis.

Liquidity Buffer: Maintain a buffer of liquid assets to cover unforeseen expenses and maintain operations during slow periods.

Strategy 2: Improving Profitability

1. Increase Gross Profit Margin

Improving the gross profit margin can be achieved by focusing on both cost reduction and pricing strategies:

Cost Reduction: Identify areas where production or procurement costs can be reduced without compromising quality. This could involve negotiating better rates with suppliers, improving operational efficiency, or adopting cost-saving technologies.

Pricing Strategies: Review pricing strategies to ensure they reflect the value delivered to customers. Consider value-based pricing, where prices are set based on the perceived value to the customer rather than solely on cost.

Product Mix Optimization: Analyze the profitability of different products and focus on those with higher margins. Discontinue or re-engineer less profitable items.

Operational Efficiency: Streamline production processes to reduce waste and improve efficiency. Implement lean manufacturing principles to optimize resource use.

2. Boost Net Profit Margin

Net profit margin can be increased by streamlining operations and eliminating inefficiencies:

Expense Management: Conduct a thorough review of all expenses and identify areas where costs can be cut. This includes administrative expenses, marketing costs, and operational inefficiencies.

Revenue Enhancement: Explore new revenue streams or improve existing ones. This could involve expanding product lines, entering new markets, or enhancing sales strategies.

Process Improvement: Implement process improvements to reduce operational bottlenecks and improve productivity. Use tools such as Six Sigma and Total Quality Management (TQM) to identify and eliminate inefficiencies.

Technology Investment: Invest in technology that can automate processes, improve accuracy, and reduce costs. This includes ERP systems, CRM software, and other digital tools.

3. Enhance ROA and ROE

Improving return on assets (ROA) and return on equity (ROE) involves strategic investment and efficient resource management:

High-Return Investments: Focus on projects and assets that offer high returns. Conduct thorough ROI analyses before committing to new investments.

Resource Utilization: Ensure that assets are being used efficiently to generate revenue. Regularly review asset performance and divest underperforming assets.

Financial Leverage: Use financial leverage wisely to boost returns without taking on excessive risk. Balance the use of debt and equity financing to optimize capital structure.

Profit Retention: Retain a portion of profits to reinvest in the business, supporting growth and increasing shareholders’ equity.

Strategy 3: Enhancing Operational Efficiency

1. Increase Inventory Turnover

Improving inventory turnover can lead to significant cost savings and improved cash flow:

Just-In-Time (JIT) Inventory: Implement JIT systems to reduce holding costs and minimize excess stock. This involves receiving goods only as they are needed in the production process.

Inventory Management Software: Use software to track inventory levels, forecast demand, and automate reordering. This helps prevent overstocking and stockouts.

Demand Forecasting: Improve demand forecasting accuracy to align inventory levels with actual sales. Use historical data, market trends, and advanced analytics.

Inventory Audits: Conduct regular inventory audits to ensure accuracy and identify slow-moving or obsolete items.

2. Improve Fixed Asset Turnover

Maximizing the utilization of fixed assets can drive higher sales and efficiency:

Asset Utilization: Regularly assess the utilization rates of fixed assets to ensure they are being used effectively. Idle assets should be put to use or disposed of.

Maintenance and Upgrades: Keep equipment and facilities well-maintained to avoid downtime and extend their useful life. Consider upgrading to more efficient technology when appropriate.

Asset Tracking: Implement asset tracking systems to monitor the location, condition, and usage of assets. This can prevent misallocation and ensure optimal usage.

Disposal of Underperforming Assets: Identify and dispose of underperforming or obsolete assets to free up capital and reduce maintenance costs.

3. Manage Debt to Capital Ratio

Maintaining an optimal debt to capital ratio is crucial for financial stability and leveraging growth opportunities:

Debt Management: Regularly review debt levels and repayment schedules. Ensure that the company is not over-leveraged, which could lead to financial distress.

Leverage Optimization: Use debt strategically to finance growth while keeping it within manageable limits. Balance the use of debt and equity to optimize the capital structure.

Interest Cost Management: Negotiate favorable terms on debt to reduce interest costs. Consider refinancing high-interest debt to take advantage of lower rates.

Capital Allocation: Allocate capital efficiently to projects with the highest returns. Avoid over-investment in low-return areas that could strain financial resources.

Conclusion

By implementing these detailed strategies to optimize financial KPIs, enterprises can enhance cash flow management, improve profitability, and boost operational efficiency. Regular monitoring and strategic use of these KPIs will provide actionable insights, driving informed decision-making and fostering sustainable growth.

Discover more:

For Consultancy Services:

©Iuppiter International Consulting. All right reserved.

Comments